Commercial property is refers to a property that for business use. Commercial properties such as shop office with an individual title, its prices are normally in the range from RM 1 million to RM 3 million or shop office under strata title with lower entry point, and its prices are normally in the range from RM 200k to RM 500k.

Like I always said, nothing is perfect, commercial property is not an exception. Although there is no perfect commercial property but you can consider to pick an investment-grade property. You may wonder why should we picking an investment-grade commercial property? Well, it can generate positive cash flow from the property itself, higher rental income and also potential capital gain.

In order to earn more profits from commercial property, here are the tips that you should be always keep in your mind while hunting one to invest in.

➊ Visibility

There is no doubt that the visibility of a property is so much important and this is the major factor that can affect a property potential capital gain. The reason of the tenant will choose to rent your commercial property is its visibility, because it can help to attract more customers to visit their shop, so they can generate more revenue and they probably will be your long-term renter.

Besides that, do mind that if there are too many businesses located in very visible location, it will affect the business itself as they cannot be accessed due to logistics problems, such as road structure. Imagine that a commercial property is at the road side and just next to the traffic light, will you choose this property to run your business? Definitely no, as it will caused traffic jam all the time and the most importantly is there is no place for the customers to park their car.

Do always keep it in your mind that never invest in the commercial property that you can see it easily but cannot be reached or accessed by vehicles or public transport.

➋ Location

A good location for a commercial property should be in a high growth area such as factories, office tower, supermarket, hospital, shopping mall and so on. Besides, a good location should be in the direction of growth of a town or city as it can decide a property potential capital gain.

Through a research from internet, the best location for a commercial property is in front of a truck road or highway as this location captures about 80% of the mobile customers and about 20% of its residential customers. This is because people have more time to do their chores such as buying food, banking, buying home accessories and etc on the way home from work or anywhere else.

Other than that, residential area also consider as a good location for commercial property and preferably at least 30 houses to one shop. This category of commercial property can attracts more local customers as well as mobile customers.

Not to forget that the demographics of the residential population is important too. Demographic statistics would be things like age, average income level, gender. The income level of the residents determines what type of business would be suitable for that area while the type of business will determine the rental income and the value of the commercial property.

➌ Supply and demand

Before buying a commercial property, do look at the supply and demand of its area and nearby the area. The commercial property price will go up if the supply is less than demand, while, if the commercial property supply is more than demand, it is considered as oversupply.

➍ Accessibility

As we mentioned above, besides visibility, the accessibility to a commercial property is very important. This is not only the ease of flow of traffic a leading to the commercial property, but also having sufficient parking space near to the commercial property.

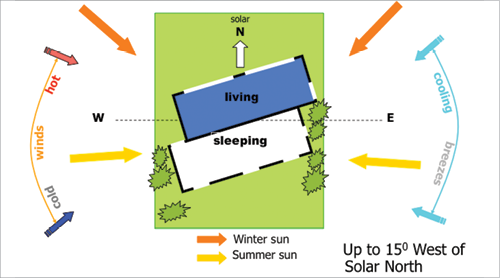

➎ Orientation and design

The orientation and design of the commercial property can also affect its rental income and its capital gain. For some commercial property that facing either to the east or west, the tenants are willing to pay more for air-conditioning due to the hot weather. Thence, commercial properties facing north or south are preferred.

The above are the main factors that can affect a commercial property capital gain over time. Although a commercial property can provide us the better rental yields, but its entry cost are often costly than residential property. Do read our another article to make the comparison between them both — Investing In Commercial Property vs Residential Property. Which one better?

It’s not about property ownership it’s about control! Visit Property Millionaire Intensive to get more details.

Do you have the desire to become financially free through property investment? Visit Property Intensive Seminar for more details.