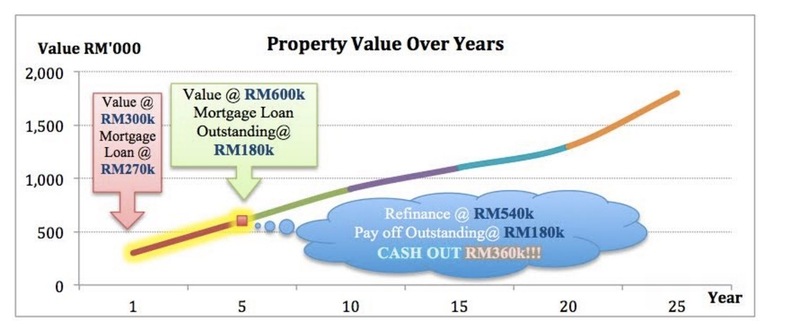

Why should we consider to refinance our home loan or mortgage loan? Let say, if you have difficulty to pay-off your home loan repayment after 5 years or you wish to generate additional cash flow for you to invest in somewhere else, then it is the best choice for you. What does it really mean is, refinancing a home loan or mortgage loan can help you to pay-off an existing outstanding loan as well as replacing it with a new one.

To clear up your doubts, you can get the answer of why you can generate more cash flow for you as below picture;

Image source: amazonaws

Besides, the homeowners and property investors are able to reap benefits from refinancing their loan;

➊ To get the lowest interest rate

➋ The opportunity to shorten the home loan or mortgage loan tenure

➌ To purchase new property

➍ Debt consolidation

➎ To switch the existing mortgage product (Fixed Mortgage term loan, flexi mortgage loans or semi-flexi mortgage loan)

Let’s us thoroughly explain to you each of them;

➊ To get the lowest interest rate

If there is a competitor bank offers you a 1% or 2% reduction interest rates, you would save from paying more interests which mean you’ll get the lower monthly repayment. Besides, if you’re rent out the property, you could be able to increase your rental cash flow as the monthly repayment is lower now.

For example, let say your loan amount is RM 500,000 and loan tenure of 30 years

| ELR 5.5% | ELR 4.5% | |

| Monthly Repayment (RM) | 2,839 | 2,543 |

| Savings (RM) | – | 305 |

| Rental Income (RM) | 2,839 | 2,839 |

| Positive Cash Flow | 0 | 305 |

Note: ELR is generally known as “Effective Lending Rate”

See? You will get another RM 305 every months! Now you can understand how it can generate additional cash flow for you should you refinance your mortgage loan.

➋ Shorten the mortgage loan tenure

You can shorten your mortgage loan tenure while you refinance your property. This may allow you to have savings on total interest that you need to pay back to the bank.

For example, let say your loan amount is RM 500,000 and ELR on mortgage loan is 4.5%

| Loan Tenure | 30 years | 25 years | 20 years |

| Monthly Repayment (RM) | 2,534 | 2,780 | 3,164 |

| Total Interest Payable (RM) | 404,645 | 327,810 | 254,487 |

| Saving vs 30 years tenure (RM) | 0 | 76,835 | 150,158 |

Do take note that the shorten the loan tenure is, the higher repayment every month. But, if BR or BLR drops in the future, you can then choose to refinance to a shorter tenure by maintaining nearly the same monthly repayments. Which means you are able to pay the same monthly repayments as you’ve always been, but, you can still pay-off your mortgage loan in a shorter period of time.

Note: BR is “Base Rate”; BLR is “Base Lending Rate”

➌ To purchase new property

By refinance your mortgage loan, you are able to cash out from your property to purchase another new property. However, do take note that the cash out should be spent on asset which can generate more income or appreciation for yourself.

The common reason for property investors to cash out from refinancing is to increase property valuation by renovate it. While the reasons for homeowners to do so are to get wedding funds, children education, travel funds, purchase the high cost goods such as furniture, cars and etc.

In sight that most of the banks in Malaysia have offer flexi-mortgage, should you decide to refinance your property with extra cash out and doesn’t know how to spend those funds yet, you may leave it in your flexi-mortgage account in order to save some interest. In this case, you would have backup cash on hand without paying any additional interest on this cash until you utilize it.

➍ Debt consolidation

Mortgage is the cheapest financing options in town which compared to auto-loan or hire purchase, overdraft, credit cards and personal loan. Refer table below on the financing rate comparison.

| Mortgage | Overdraft | Auto Loan | Credit Card | Personal Loan | |

| Effective Interest Rates (%) | 4.4% – 5.0% | 5.5% – 6.5% | 5.5% – 6.5% | 15% – 18% | 15% – 20% |

With regards to debt consolidation, refinancing will help you to have pay-off the debts that their interest rates are higher than mortgage loan. For example, a credit card charges with an effective rate of 15-18% and up to as high as 20% for a personal loan. Comparing to the mortgage interest rate of <5%, credit card and personal loan’s interest rates is like x3-4 more expensive.

A wise consumer will use the refinancing money to pay-off the outstanding amount of credit card or personal loan to enjoy potentially 3 times or up to 4 times interest savings.

➎ Switching the existing mortgage product

Should you’re having a variable rate loan (pegged against BR or BLR) but predict that there will be significant interest rate hikes (for instance higher OPR rate adjustment), it would be better to refinance your mortgage into a fixed rate loans now. As such, your monthly repayment amount does not increase even if increases of BR or BLR .

Alternatively, switching from a fixed-rate loan to a variable rate loan can also be a good financial strategy, especially in a falling interest rate moment. If the interest rates fall continuously, the periodic rate adjustments on BR or BLR will result in decreasing ELR and lower monthly mortgage repayments, wipe out the need to refinance every time rates drop.

So, refinance the mortgage loan is not only the property investors’ game but the homeowner can try out this method to decrease the interest rate on mortgage loan as well as can get additional cash out from refinancing to get honeymoon funds and for your children education funds in the future.

If you want to learn more about property investment, click the following link: PropertySeminar.com.my

How to use creative strategy to own a property in Malaysia? Click the following link to learn more: PropertyMillionaireIntensive.com