Richard Oon sheds light on how to minimize the largest and surest cost of any real estate investment – Taxation.

Many property investors in Malaysia actually pay unnecessary taxes as their understanding of the taxation fundamentals in property investing is severely lacking. As revealed by Richard, one grave mistake many property investors make is to use the Returns on Investment (ROI) rule as a yardstick for evaluating their investment yields. Encouraging property investors to look at ‘net returns after tax instead, Richard shared that this figure is actually more accurate as it does not mislead (potential) property investors by painting an “attractive” picture.

For instance, unlike stamp duty and legal fees, interest is not a tax deductible item. Hence, when it comes to calculating the chargeable tax rates on the sale of a property, interest expense is not allowed to be deducted from the total chargeable gain.

TAX MITIGATION STRATEGIES

Elaborating on a few facts that property investors have to face this year, Richard also shared his tips on how to minimize the consequent tax exposure.

[bctt tweet=”TAX – Navigating The Tax Minefield Of Property Investments”]

1. Keep track of the change in taxation laws

Property investors have to be alert of any amendments or introduction of new laws as it will affect the amount of tax they have to pay for their property investment activities. Not all changes would be in favour of property investors.

For example, business entities/individuals that own buildings such as warehouses, hotels, and schools and leases them out for steady income can no longer claim Industrial Building Allowance (IBA) as from the assessment year of 2016. Hence, those looking to renovate buildings with the purpose of renting or leasing them out will have to re-evaluate their cash flow as they will not be able to claim tax breaks for maintaining their asset.

2. Know your taxes

One common misconception among property investors is that the disposal of properties can only be subject to RPGT. RPGT applies for the gains on the sale of a long-term investment, which is treated as a capital gain.

However, if the gain on sale is perceived as an income, for example where the transaction is one-off and has the semblance of trade, then Income Tax (IT) will apply. Also known as ‘adventure in the nature of trade’, an example of this ‘profit-motive’ activity would be the holding of properties as stock with the intention of resale.

In order to determine whether their sales proceeds will be subjected to RPGT or IT, property investors are advised to carry out the ‘badges of trade’ test. It is an internationally accepted guide to determine whether the disposal of a property is an ‘adventure in trade’ or not. A few key badges that pin a transaction under IT (income) or RPGT (capital) are as below:

Property investors must take stock of what tax rate is applied to them, as one way to minimise property taxes is to know which transactions can be classified under IT. With the changes in the RPGT rates, IT rates are now actually lower than RPGT rates for properties disposed of within a certain time period.

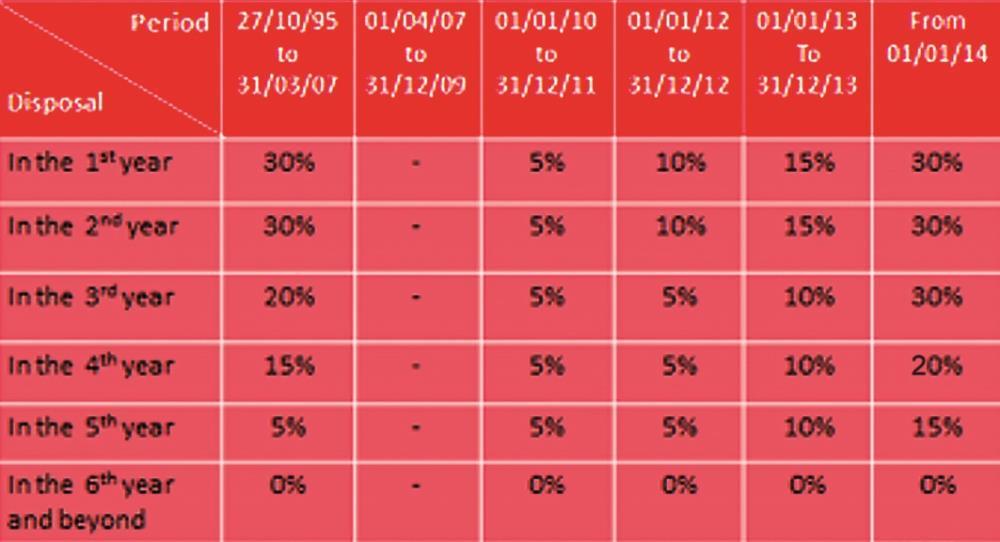

RPGT would be favourable only for longer-term investments, particularly for an asset held for more than 5 years. The table below shows the changes in RPGT rates over the years:

For those who with short–term investments who dispose of their properties within four years should consider putting such properties in a Sdn Bhd or a Limited Liability partnership (LLP) where the tax is lower when assessed as a trading activity under IT. By setting up a separate entity such as the Sdn Bhd or LLP, they will also be able to shield any properties legitimately held for long-term investments from being exposed to income tax implications.

3. GST and commercial property

With the introduction of the Goods and Services Tax (GST) on 1 April 2015, property investors now will have an additional matter to consider in their property investment decision making.

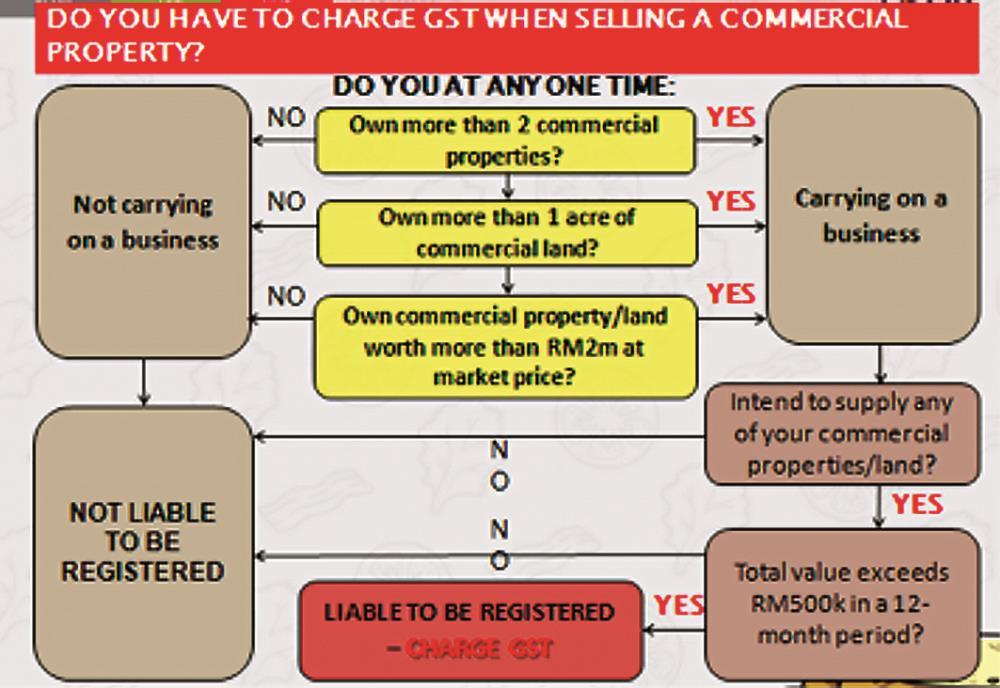

GST is especially important for those who are looking to invest in commercial properties as the 6% GST has to be incorporated into the selling price of the property. This includes shop lots, shop offices, small office virtual offices (SoVos), factories, hotels, and warehouses. The guide below provides some clarity for commercial property owners:

As highlighted by Richard, property investors must execute tax planning even before they buy any property and not only when they decide to sell it off. He concluded by reminding investors that they stand to gain considerable savings in tax charges if they develop a tax plan that best suit their investment strategies.

Resources: WMA PROPERTY